Net present value of annuity calculator

If you use IRR for mutually exclusive projects you might end up selecting small projects with higher IRR and a short-term nature at the expense of long-term long-term value creation is good for shareholders and higher NPV. Why is a NPV calculation useful.

Tax Shield Formula How To Calculate Tax Shield With Example

The Time Value of Money.

. This calculator generates the output value of YTM in percentage according to the input values of YTM to select the bonds to invest in Bond face value Bond price Coupon rate and years to maturity. See Present Value Cash Flows Calculator for related formulas and calculations. 5500 after two years is lower than Rs.

Why use a net present value calculator. Present Value Annuity Factor PVAF Calculator. Present value of annuity calculation.

With this calculator you can find several things. Future cash flows are discounted at the discount. Savings Calculator calculate 4 unknowns.

5000 it is better for Company Z to take Rs. As present value of Rs. Annuity formulas and derivations for present value based on PV PMTi 1-11in1iT including continuous compounding.

Figure Out the Net Present Value of an Annuity. Present Value Growing Annuity PVGA Payment Calculator. Calculate the net present value NPV of a series of future cash flowsMore specifically you can calculate the present value of uneven cash flows or even cash flows.

To calculate the PV of the perpetuity having discount rate and growth rate the following steps should be. Once we sum our cash flows we get the NPV of the project. The present value of annuity formula relies on the concept of time value of money in that one dollar present day is worth more than that same dollar at a future date.

In this case our net present value is positive meaning that the project is a. Present Valuation Structured Settlement Calculator. To calculate the current value the ordinary annuity formula is used to determine the ordinary annuity calculator present value.

Explanation of PV Factor Formula. Step 3 Next determine the discount rate. Time Value of Money Tutorials.

An annuity is an investment that provides a series of payments in exchange for an initial lump sum. If you wish to choose one single project from amongst many NPV will be a good measure of profitability. Value of an Annuity present value of cash flow.

Present Value - PV. Present Value or PV is defined as the value in the present of a sum of money in contrast to a different value it will have in the future due to it being invested and compound at a certain rate. Calculate the present value of an annuity due ordinary annuity growing annuities and annuities in perpetuity with optional compounding and payment frequency.

Unlike the IRR or MIRR calculations that express results in percentage terms the NVP calculation reveals its results in dollar terms. Rate Per Period As with any financial formula that involves a rate it is important to make sure that the rate is consistent with the other variables in the formula. See How Finance Works for the compound interest formula or the advanced formula with annual additions as well as a calculator for periodic and continuous compounding.

Good Measure of Profitability. Present value PV is the current worth of a future sum of money or stream of cash flows given a specified rate of return. A popular concept in finance is the idea of net present value more commonly known as NPV.

In the formula the -C 0 is the initial investment which is a negative cash flow showing that money is going out as opposed to coming in. Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time-adjusted to the present day. Net Asset Value NAV Calculator.

The payment that would deplete the fund in a. Calculating the present value of an annuity due is basically discounting of future cash flows to the present date in order to calculate the lump sum amount of today. Suppose you inherit 50000 and you want to know if investing that lump sum will cover your childs tuition and.

There can be no such things as mortgages auto loans or credit cards without FV. If youd like to know how to estimate compound interest see the article. To learn more about or do calculations on present value instead feel free to pop on over to our Present Value.

Interest Rate discount rate per period. The actual value of an ordinary annuity calculator which is a series of equal payments payable at the end of the following periods can be measured with the current value of the standard annuity calculator. FV along with PV IY N and PMT is an important element in the time value of money which forms the backbone of finance.

Calculate the Present Value PV of a future sum of money or cash flow based on a given rate of return and investment term. Present Worth calculator Present Value Calculator including Present Value formula and how to calculate PV of an asset based on its discount rate. Step 4 To arrive at the PV of the perpetuity divide the cash flows with the resulting value determined in step 3.

But you will need this present value calculator to plan your childs education or any other major expenses or purchases. Number of Periods Annuity - Present Value PV Calculator. Weighted Average Cost of Capital WACC Calculator.

Yield to Maturity Calculator is an online tool for investment calculation programmed to calculate the expected investment return of a bond. Stock Risk Premium Calculator. Considering that the money going out is subtracted from the discounted sum of cash flows coming in the net present value would need to be positive in order to be considered a valuable investment.

PV of Annuity Due 500 1 1 1 1212 12 1 12 PV of Annuity Due Explanation. Present value means todays value of the cash flow to be received at a future point of time and present value factor formula is a toolformula to calculate a present value of future cash flow.

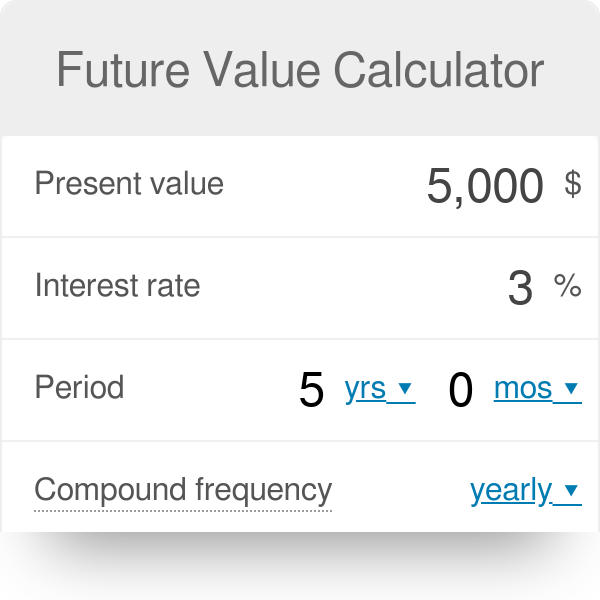

Future Value Calculator With Fv Formula

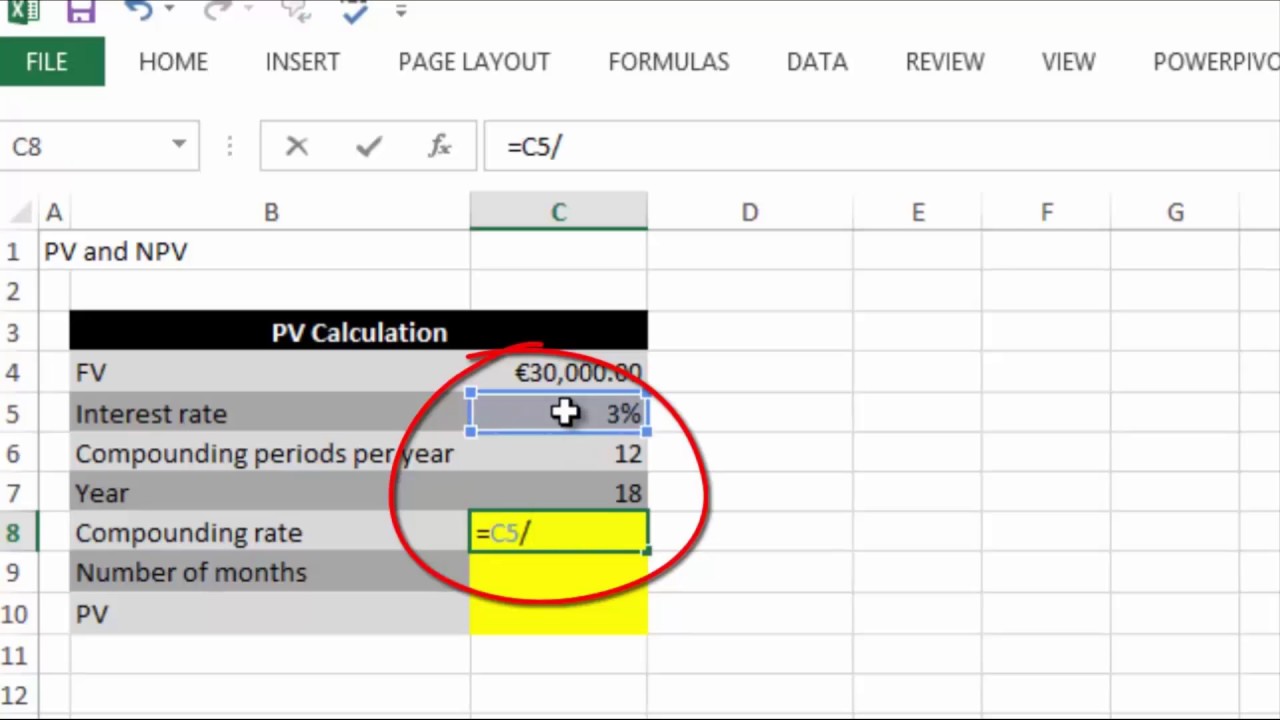

How To Calculate Pv Of A Different Bond Type With Excel

Payment Pmt And Total Interest Future Value Ordinary Annuity Financial Calculator Sharp El 738 Youtube

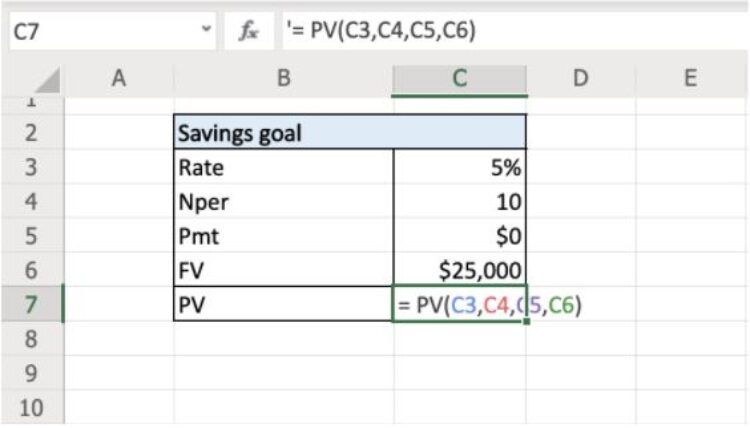

How To Calculated Present Value In Excel Youtube

12 2 Constant Growth Annuities Mathematics Libretexts

Excel Formula Future Value Of Annuity Exceljet

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

How To Calculate Present Value Factor On Calculator Youtube

Microsoft Excel Time Value Function Tutorial Uneven Cash Flows Tvmcalcs Com

Introduction To Present Value Interest And Debt Finance Capital Markets Khan Academy Youtube

Present Value Of Annuity Calculator

How To Calculate Present Value In Excel Financial Calculators

Excel Formula Future Value Of Annuity Exceljet

Present Value Of Cash Flows Calculator

Calculating Present Value Accountingcoach

How To Calculate Present Value In Excel Financial Calculators