401k max contribution 2021 calculator

The actual rate of return is largely. Anyone age 50 or over is eligible for an additional catch-up.

The Maximum 401 K Contribution Limit For 2021

Reviews Trusted by Over 20000000.

. As you enter the information in each of these categories you will finds that our 401k Retirement Calculator updates the figures and gives you a final figure as you press Calculate. In 2022 100 of W-2 earnings up to the maximum of 20500 and 27000 if age 50 or older can. It provides you with two important advantages.

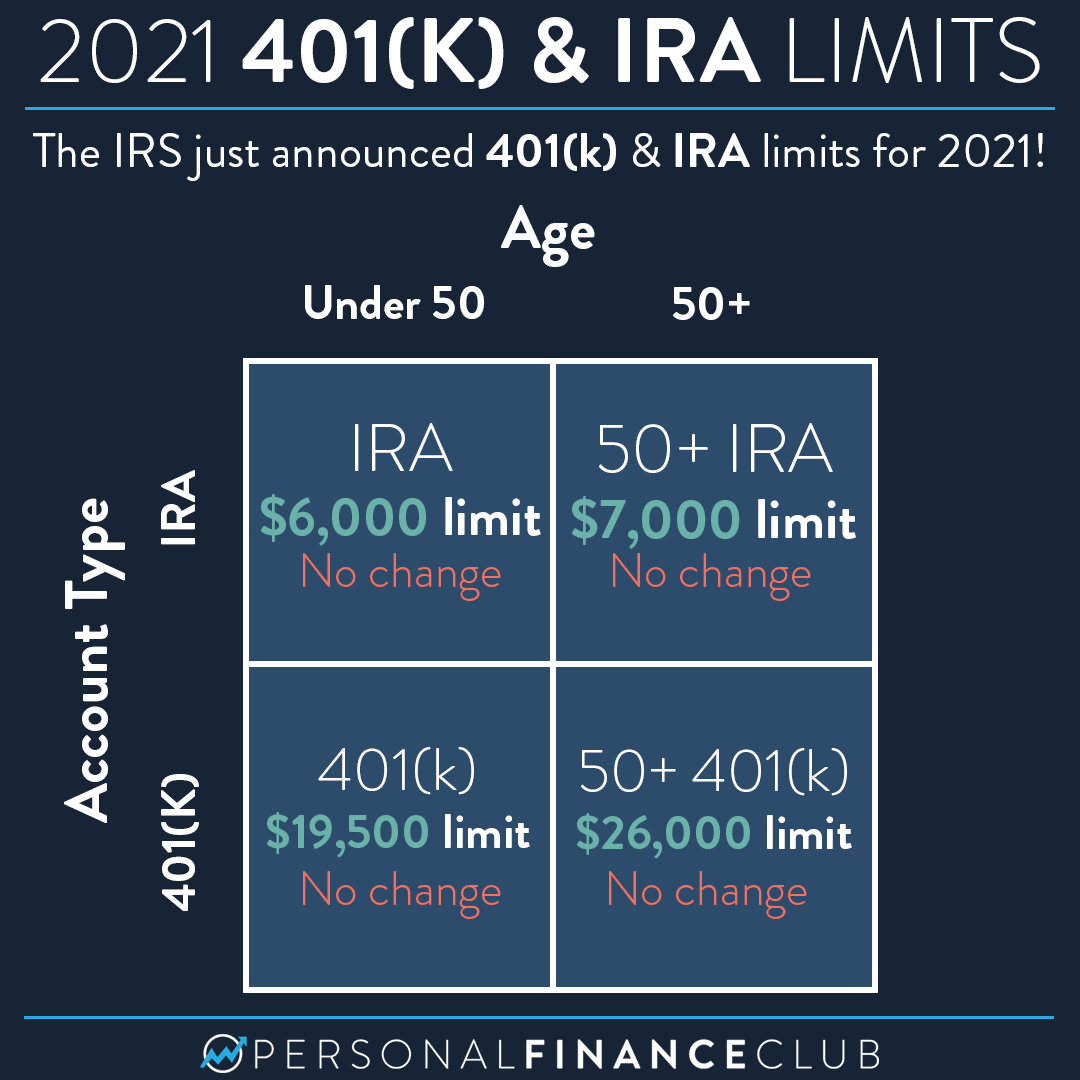

If you are 50 years old or older the maximum contribution limit went from 63500 in 2020 to 64500 in. The 401k contribution limit for 2022 is 20500. The 2021 deferral limit for 401 k plans was 19500 the 2022 limit is 20500.

There is an upper limit to the combined amount you and your employer can contribute to defined 401 ks. When you set up a 401k you can opt to have a certain amount of. You may contribute additional elective.

The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older. Specifically you are allowed to make. First all contributions and earnings to your 401 k are tax deferred.

Employees can contribute up to 19500 to their 401 k plan for 2021 and 20500 for 2022. An employee contribution of for An employer. Ad If you have a 500000 portfolio get this must-read guide from Fisher Investments.

Solo 401k contribution calculation for an S or C corporation or an LLC taxed as a corporation. This calculator assumes that your return is compounded annually and your deposits are made monthly. Supplementing your 401k or IRA with cash value life insurance can help.

After not being able to find any calculator or formula online for what I was looking for I decided to sit down and create my own. The maximum limit went from 57000 in 2020 to 58000 in 2021. Your retirement strategy should begin with a tax-advantaged retirement account but it doesnt have to end there.

If permitted by the 401 k plan participants age 50 or over at the end of the calendar year can also make catch-up contributions. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit. The annual 401k contribution limit is 20500 for tax year 2022 with an extra 6500 allowed as a catch-up contribution every year for participants age 50 or older.

The IRA contribution limits are below. Ad Discover The Benefits Of A Traditional IRA. Ad Roll Over Existing IRA Accounts and Manage Your Fidelity Account Today.

Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge. Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Compare 2022s Best Gold IRAs from Top Providers.

Employees 50 or over can make an additional catch-up contribution of 6500. The contribution limit for an IRA is about a third of what can be contributed to a workplace plan. Ad Maximize Your Savings With These 401K Contribution Tips From AARP.

For those age 49 and under the limit is 61000 in 2022 up from 58000 in 2021. With a solo 401k you are allowed to make contributions in the role of employee and the role of employer. Ad Discover The Benefits Of A Traditional IRA.

This calculator below tells you what percentage. Learn About 2021 Contribution Limits Today. Learn About 2021 Contribution Limits Today.

Consider a defined benefit plan if you want to contribute more than the 2022 Individual 401k contribution limit of 61000. The annual rate of return for your 401 k account. 401k and Roth contribution calculator.

Gain Access to a Wide Range of Investment Options When you Transfer To a Fidelity IRA. Plan For the Retirement You Want With Tips and Tools From AARP. A One-Stop Option That Fits Your Retirement Timeline.

A One-Stop Option That Fits Your Retirement Timeline. Step 1 Determine the initial balance of the account if any and also there will be a fixed periodical amount that will be invested in the 401 Contribution which would be maximum. 457 savings calculator.

A 401k plan and a profit sharing plan can be combined with a. A 401 k can be one of your best tools for creating a secure retirement.

Employer 401 K Maximum Contribution Limit 2021 38 500

After Tax Contributions 2021 Blakely Walters

Customizable 401k Calculator And Retirement Analysis Template

Solo 401k Contribution Limits And Types

2021 Contribution Limits For 401 K And Ira Personal Finance Club

Here S How To Calculate Solo 401 K Contribution Limits

Solo 401k Contribution Limits And Types

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Free 401k Calculator For Excel Calculate Your 401k Savings

The Maximum 401k Contribution Limit Financial Samurai

Solo 401k Contribution Limits And Types

Who Should Make After Tax 401 K Contributions Smartasset

The Maximum 401k Contribution Limit Financial Samurai

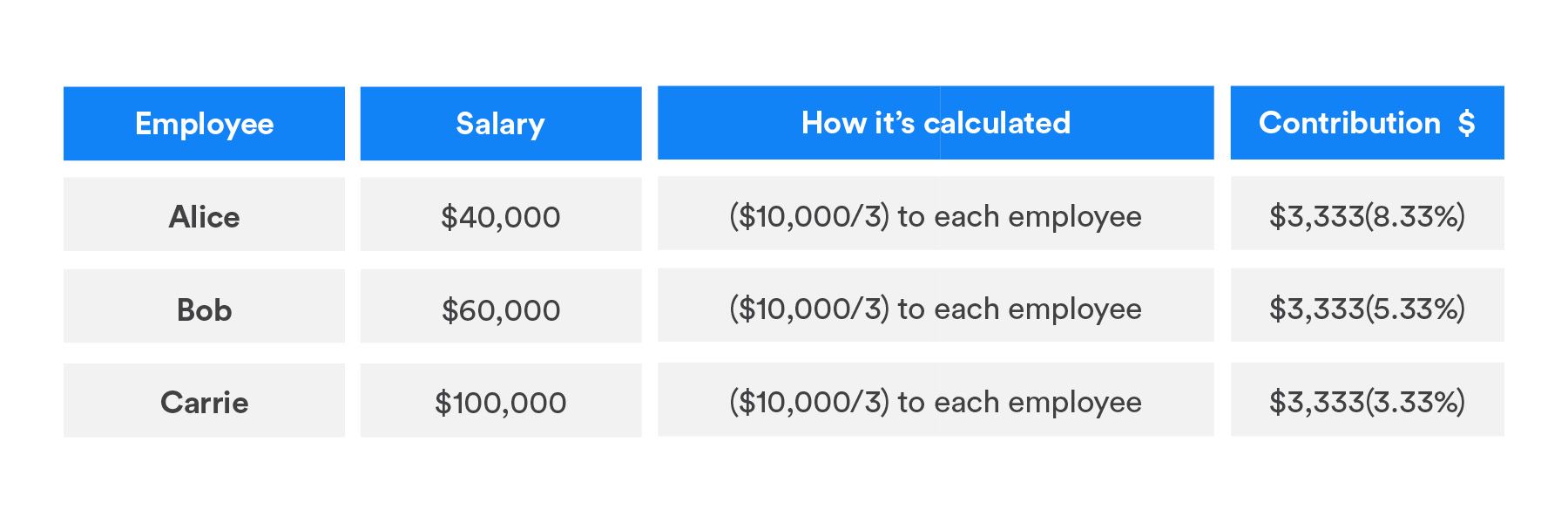

401 K Profit Sharing Plans How They Work For Everyone

Solo 401k Contribution Limits And Types

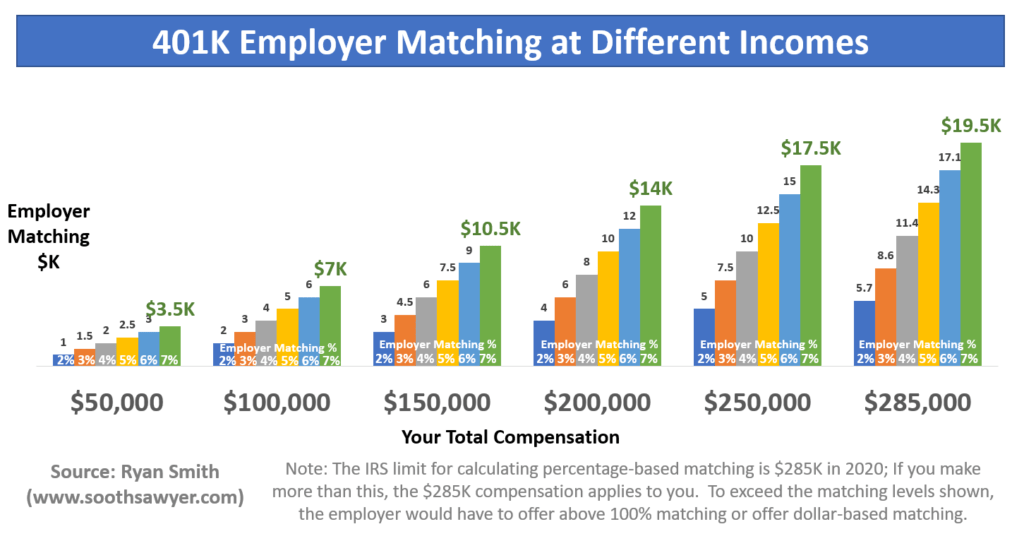

Do You Max Out Your 401k Mid Year Stop Immediately Soothsawyer

Understanding The Mega Backdoor Roth Ira